So this is my first time on “the other side of the table,” I have made investments personally but now I am working as part of a team to ensure we make successful investments for ourselves, our investees and our backers.

Bringing together £10m is proving less difficult than I expected. To be truthful I feel we may have been setting the bar too low and will be calling for more investment in the coming months. The harder part has been finding businesses of the standard we can believe in.

It’s been a fascinating journey already. I’ve rightly been termed “gamekeeper turned poacher,” and have a whole new point of view on what makes a strong founding team. I’m so blessed to have the best early-stage tech funding team on the planet to support me. Together we will create £BNs in value for our shareholders over the coming decade. I look forward to my own articles in 2029.

Here are 10 facts I have picked up on this journey after 3 months and 3 days!

1. Don’t back a donkey and expect to be able to whip it into running like a racehorse, or to transform into a unicorn.

We have seen 30+ pitches now. Even at this stage it’s getting easier to split the expected successes from the failures. We are looking to create £1BN companies. A founder must have huge aspiration or need not apply. A Change backed company is not a lifestyle business, it’s a contribution to the world.

No matter how good someone is at their job, or how many 1,000s of hours of experience they have aptitude alone will not cut it in businesses that aim to disrupt. Attitude and coachability are required.

I used to believe everyone seeking venture capital thought like me. I have friends who have had exits at £100mns and others on course for £Bns those people always did! When you have a peer group like that you don’t feel satisfied, a nice house and car, will not fulfil you, no matter how big or flash. You’re more likely to pour your time and resource into making your impact on the world. An impact that you fundamentally believe in.

2. How you act matters on the way in and the way out

Before the Change we made a few investments that really helped us cut our teeth on the industry. We have had one that didn’t work out as we wanted or expected. Expectations had not been aligned between us and the founder.

We tried everything we could to help the founder. Unfortunately, we could not find a way to deliver success. After less than a year the founder moved on. This was a major lesson for us.

a. A founder of a major company needs the guidance of a qualified value to add board. For our founder, we didn’t have board meetings we instead just met from time to time ie the angel approach.

b. A founder of a £Billion company needs to have the passion and share our values. Some we can coach and those we can’t add value to for various reasons.

c. A founder will be tested from day 1 of a start-up and the challenges keep growing. The Team might be small but the hurdles certainly won’t be. This environment is certainly not for everyone. The mindset must be aware of these challenges and be prepared for them even before the journey starts. We need to establish if it’s there and then nurture it.

Regardless of these desirable qualities it still may not work out. In the Changes opinion the founder is not someone to throw on the scrapheap but rather to rehabilitate back into society. Maybe it was the idea that was wrong, maybe it was the wrong time, maybe founding £1billion companies isn’t something the founder is ready for.

In any of these scenarios we see founder rehabilitation as paramount. While other VCs have in their term sheets that founders loose their shirt, for us the people we invest in we are invested in for the long haul and we have put together a founder rehabilitation fund for those who don’t make it to soften the blow of a return to “normal life.”

Why do we do this? Well the problems are clear; negative PR, legal costs, bad feeling, loss of positive energy and MOST importantly personal trauma for founders of companies aiming to change the world have to be worth £20,000 at the other end. Who knows, that founder could in a future life make a great employee for The Change or come back stronger with a new start-up that the Change might back.

We have learned great lessons in our first founder exit. We believe we delivered a fair outcome despite difficult circumstances, but we did it all by “happenstance,” going forward we have a planned strategy for targeted support through start-up, scale up, and exit.

For the sake of the industry I hope other VCs will begin to mirror our approach.

3. #UnicornJockeys

Already we see that riding, would be, unicorns is very different than riding the normal common or garden racehorse, or even riding a prizewinning donkey. Learning how to fly a Pegasus with superpowers just isn’t the same as travelling the course on a normal Aà Z trading business. When you think big and dream big you have to do things differently.

Unicorns need different equipment, different food for their thoughts, different types of guidance and different types of love to become the amazing creatures they are born to be.

We coined the term #UnicornJockeys off the back of our goals and aspirations. The members of our Team have owned and worked on £multi-million companies, high tech start-ups, corporates and scale ups. We have in our fold experience of the purchase and sale of £multi-billion companies. That stuff is good but just as important are my dreams for setting strategies around how we together can change the world.

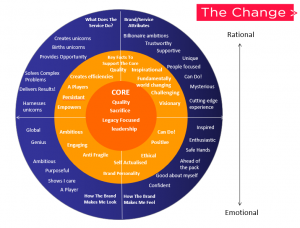

4. Values Matter to #Unicorns & #UnicornJockeys

Values are core. Attitude is important in a start-up; but mostly you need to be coachable to see the future and realise the terms of the present or you probably won’t succeed!

Legacy thinking, the desire to create something bigger than ourselves is a core attribute of a Change Founder.

Leadership is essential If someone can’t lead then they need to find someone who can to support them in their adventures in business!

Quality is critical. The number of founders who “blag it,” perhaps isn’t surprising to most. It has been to me! Some people promise to get back to you agree to do certain things by certain dates and invariably don’t come up with the goods. Those companies that don’t take their own or our time seriously can be easily weeded out from the mix.

Sacrifice is essential. I will never forget the words of Mark Evans of Kindred Capital when he explained to me what was ahead if we took on capital. This will be the hardest journey of your life was the resounding message. It was a speech I have never forgotten. I knew he was right, but I knew by the same token he would have been such an amazing guide to anyone walking that difficult journey. I wanted to give up everything to follow my dream. Many founders don’t perhaps realise that even when you are worth millions on paper you won’t be able to enjoy it until the job is done!

Some-day I hope for founders to look back on time with me, as I know those mentored by Mark look back on him! Fond memories through hard times and good ones!

5. The Clock is ticking… Time waits for no one…

Often finding people is all about timing.

One of the first recipients of funding the change has backed was an individual with clear ambition and talent. He even held the right values BUT he had been working on the wrong thing at the wrong time. This was until a key meeting caused an epiphany that changed his life forever. Moments mean everything when you are trying to turn a racehorse into a unicorn.

Often nascent entrepreneurs don’t see the gaps in their own experience and as a result can fail to recognise the true consequences of investing in the wrong project at the wrong time.

In Northern Ireland the gravy train of grant funding can slow down ideation and result in founders who have the false belief that their great idea will still be viable in around 5 years. There’s a feeling that there’s no time pressure. That extra year’s delay caused by taking a £10k grant and waiting for a £25k one, before taking on adequate funding can kill many a business in fast moving sectors. This problem does not happen as often in places where grant funding is more difficult to come by. The grants are well meaning and I’ve had the benefit of them in the past for which I’m grateful, but they have become part of the problem now.

To me there are two types of plays. IP/ product plays where being early to the party is critical and market plays where traction is the main play. Anything easy to achieve doesn’t usually stack up, although being at the right time is everything. Becoming an incumbent in a key industry can make a very attractive investment, given incumbents are hard to shift just as deep tech plays can be also.

In either scenario the quicker we make the decision and more thoroughly we do our due diligence the better!

6. Founder is as founder does

I want to caveat that not all founders are unhinged BUT they see the world differently than other mortals and it’s very difficult nigh on impossible for non-founders to understand their motivations. They see a need for change and disruption in a way that it isn’t possible for the average 9 to 5 worker to get.

When you make an investment in a founder, you do so knowing that there’s a high degree of certainty that they’re a random thinker. You often don’t know what they are going to do next, but you trust their nose to find the gold others have missed. Often founders can do extraordinary things. At the other side is everything from depression, passion, anger, empathy and single mindedness (maybe even bloodimindedness!)

Even the most brilliant of minds have their faults and need coaching, mentorship and guidance just as the rest of us do. We want to enhance the founders mind, empower their senses and unleash their ability to bring useful novelty to the world.

We accept founders for who they might be whether structured and passive or passionate and fiery. We aim to help founders get to know themselves and become the best version of themselves that they can be.

We also aim to support the teams that work with founders. The aim is the perfect unification of creativity, novelty, repeatability and systematisation that with it brings £billion innovations.

7. Is it a product OR Is it a service?

Early stage companies can often have an overly simple viewpoint on how to build success. They believe they know what the corporate trade sale means and suggest they know what their 10 year exit will really look like. Often they have read books and understand other founder journeys but of course they often have no tangible experience themselves outside of hearsay.

Nascent and even serial entrepreneurs will miss that which is obvious to a corporate fund manager from first viewing. Building a team around a founder that knows the rungs of the ladder and how they can be achieved is essential. Without Laura Bond we might struggle to know what great looks like!

What I am saying is if there is a service you can offer more cheaply because of leverage on your technology well do that as a first step to market. You will reduce your cash burn and be able to test new methods within a bubble under your own control. Yes service is a lower and different multiple BUT it’s still a multiple of something.

If on the other hand you know it’s product first, then run that by an experienced person who has seen 100 companies for every one you have started. Leverage the experience you can rely on!

8. Governance

As founders ourselves we can often think a founder will see the obvious. Maybe those of us who are serial entrepreneurs do BUT the obvious for a first time entrepreneur is not obvious. The world is full of new and shiny things. Governance is the reality check and the time the blinkers get put on so the head goes down and together we run towards the next goal.

On the other-hand unicorns need blue open skies to fly as high as they are able and strategy should be interspersed with the monthly delivery checks demanded by good governance.

Like a swimmer, a founder needs to come up for air and shoot the breeze, test the market and make sure they are running or flying in the right direction.

9. Always Add Value – Riding the Unicorn!

Some would argue Unicorns don’t do well with jockeys on board. Some would argue they don’t want or need them, that unicorns are born to be free. The truth is that unicorns start as horses. They only become unicorns when they begin to believe in themselves. Unicorns are imagined not born and it’s because of this that many a would be unicorn is put in an environment where it is encouraged to dampen its spirits to get used to that feeling it’s only a horse and that it should forget the possibility that it has any hope whatsoever of ever learning to fly.

A unicorn jockey unlike a jockey on a race-horse jockey needs to take time and attention to steer the horse to bigger and greater things so that one day it will wake up in the morning to have turned into a unicorn!

At the early stage for us that has meant:

a. Coaching people to search for their horizon 4 models from the beginning

b. Building confidence and preparedness to make mistakes often so as to learn and grow ready for the bigger tasks in the future

c. Facilitating self-awareness in the team so they realize the GAPs and what they need to close them so they can grow wings

d. Unicorns are much tougher than racehorses. A unicorn needs to be driven further and faster so that’s just what we do. We aren’t waiting on your big pitch we are getting you ready to pitch by nature from the start

10. Transformation Value

We have learned that we are a company set to transform mindsets. That’s our USP. So whether an existing company which wants to grow but has hit a block.

New companies who just don’t know how to aspire to bigger things than a trading business or those companies who are scared they may become obsolete we are most probably the ones for you.

a. We bring mindset

b. We support you in finding the people to fill the gaps

c. We get you ready for growth and change

d. We identify the models that will take you into the future

e. We supply you with the information it takes to grow your business’s wings and horn!

f. We supply the funds you need

Remember as an existing business you have most probably already learned how to create a business YOU simply may not have yet learned how to create a unicorn as yet.

Feel free to get in contact there is no obligation to proceed.

Hunting for Unicorns

Finding Unicorns is no mean task. After all they may not even be real. No one has ever seen one until they seemingly appear from nowhere emerging as an overnight success! It is my belief that values are a key component from the start for the unicorn to be created. There are many millionaires in Northern Ireland but very few billionaires. There is a simple reason for that. Most people want a BMW, a house they can show off to their friends, make sure their kids have enough and they want status to show that they are successful. It’s a simple fact that the average isn’t looking to change the world. They just want to make sure they own a stake in it. Billionaires however are different people altogether. They could afford any car or mansion they wanted and yet invariably they see money as a consequence of their effort, not the reason for it.

If you’re a Unicorn waiting to appear to the world and you want to create your own billion-dollar mindset contact us. Let’s grow together!

Recent Comments